Taxes Zone Barisal BSLTAX job circular for 2023 has been officially published on the websites https://tax.barisal.gov.bd/ and http://bsltax.teletalk.com.bd. It is considered one of the most appealing government job circulars in Bangladesh. If you are interested in securing a government job in Bangladesh, the Taxes Zone Barisal BSLTAX job circular for 2023, available at https://tax.barisal.gov.bd/, is an excellent opportunity. You can apply for the job online at http://bsltax.teletalk.com.bd. Here are more details about the job circular provided by http://bsltax.teletalk.com.bd for 2023.

Taxes Zone Barisal BSLTAX Job Circular 2023

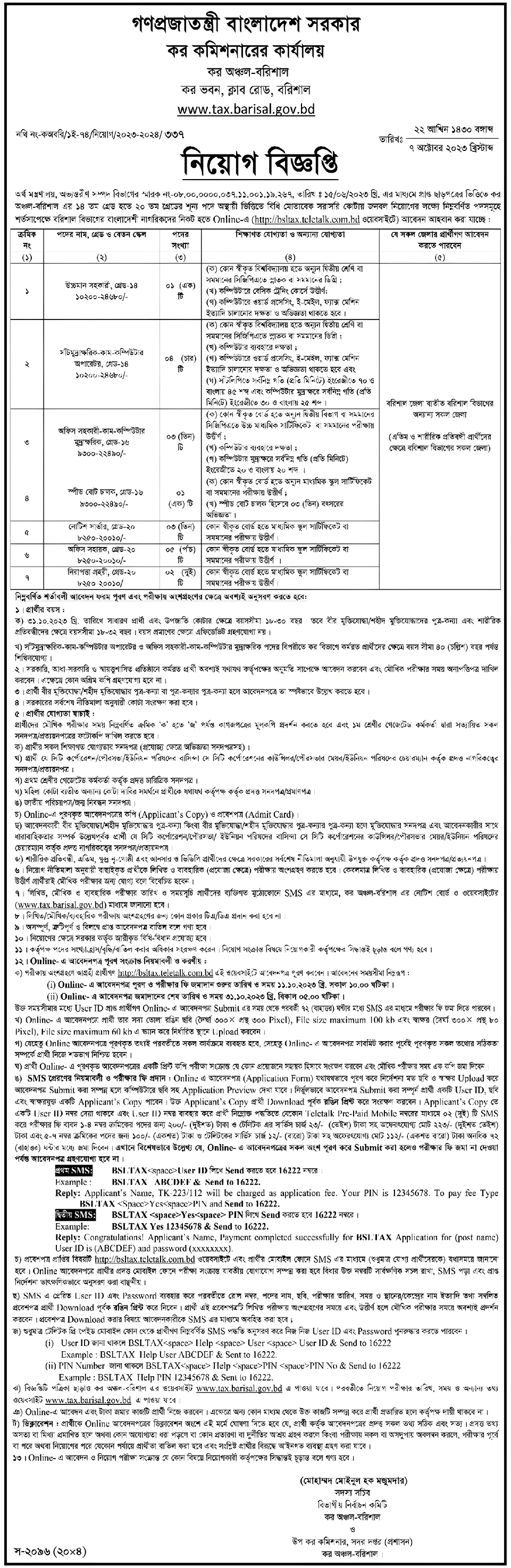

The Taxes Zone Barisal BSLTAX job circular for 2023 has been published on 07 October 2023, targeting educated and qualified individuals. This circular aims to hire 19 individuals for 07 post. The online application process will commence on 11 October 2023, at 10 AM and conclude on 31 October 2023, at 5 PM. Eligible candidates who are interested can submit their Taxes Zone Barisal BSLTAX job application form on the Taxes Zone Barisal BSLTAX website: http://bsltax.teletalk.com.bd.

BSLTAX Job Circular 2023

BSLTAX job circular for 2023 offers new government jobs through an online application process available at http://bsltax.teletalk.com.bd. This job circular provides an excellent career opportunity for unemployed individuals. Taxes Zone Barisal BSLTAX Teletalk has invited applications from genuine Bangladeshi citizens for the job circular available at https://tax.barisal.gov.bd/.

The Taxes Zone Barisal BSLTAX job circular for 2023 is a golden opportunity to secure a respectable job in the government sector. The job circular available at http://bsltax.teletalk.com.bd is one of the best government job circulars in Bangladesh. By working under the Taxes Zone Barisal BSLTAX, you can earn a handsome living. If you are interested in applying for a Taxes Zone Barisal BSLTAX job, please read the details of the Taxes Zone Barisal BSLTAX Teletalk job circular for 2023.

Taxes Zone Barisal Job Circular 2023 Job Summary

| Organization Name | Taxes Zone Barisal |

| Job Category | Government Jobs |

| Posts Category | 07 |

| Total Vacancies | 19 |

| Job Type | Full-time |

| Salary Scale | See the circular image |

| Published On | 07 October 2023 |

| Application Start Date | 11 October 2023 |

| Application Last Date | 31 October 2023 |

| How to Apply | Apply online for the Taxes Zone Barisal Job Circular at http://bsltax.teletalk.com.bd |

All Information Related to Taxes Zone Barisal Job Circular 2023

| Taxes Zone Barisal Job Circular 2023 | |

| Employer | Taxes Zone Barisal |

| Post Name | See the circular image |

| Job Location | Anywhere in Bangladesh |

| Posts Category | 07 |

| Total Vacancies | 19 |

| Job Type | Full-time |

| Job Category | Government Jobs |

| Gender | Both males and females are allowed to apply. |

| Age Limitation | For general candidates, the age should be between 18 and 30 years and for quota holders, the maximum age is 32 years. |

| Educational Qualification | Candidates who have passed Class Eight, SSC, HSC, or have an Honours Degree can apply |

| Experience Requirements | Freshers are also eligible to apply |

| Districts | Refer to the Taxes Zone Barisal job circular image for details. |

| Salary | See the circular image. |

| Other Benefits | As per government employment laws and regulations. |

| Application Fee | 100, 200, 300, 500 taka |

| Source | Online |

| Published On | 07 October 2023 |

| Application Start Date | 11 October 2023 |

| Application Last Date | 31 October 2023 |

Employer Information:

| Employer | Taxes Zone Barisal |

| Organization Type | Government Organization |

| Head Office Address | Barisal, Bangladesh |

| Phone | N/A |

| N/A | |

| Official Website | https://tax.barisal.gov.bd/ |

Taxes Zone Barisal Job Circular Overview

Taxes Zone Barisal is currently seeking qualified and passionate individuals to fill various positions within the organization. The available roles span across different departments, including but not limited.

Eligibility Criteria:

The specific requirements for each position may vary, but generally, the following qualifications and skills are desirable:

Both males and females are allowed to apply

For general candidates, the age should be between 18 and 30 years and for quota holders, the maximum age is 32 years

Educational qualifications relevant to the respective role (Class Eight, SSC, HSC, Honours Degree or have a B.Sc. in Engineering, MBA can apply.)

Prior experience in the relevant field is an advantage, but fresh graduates are also eligible to apply.

About Taxes Zone Barisal:

Taxes Zone Barisal: Navigating the Tax Landscape in Southern Bangladesh Located in the southern part of Bangladesh, Taxes Zone Barisal plays a vital role in the country’s revenue collection and taxation system. Barisal, one of the six administrative divisions of Bangladesh, is known for its lush green landscapes, numerous rivers, and rich cultural heritage. Within this region, Taxes Zone Barisal oversees tax collection and compliance, contributing significantly to the national economy.

Responsibilities and Jurisdiction:

Taxes Zone Barisal is responsible for administering and enforcing various types of taxes, including income tax, value-added tax (VAT), customs duty, and excise duty, among others. The zone covers several districts, including Barisal, Bhola, Patuakhali, Barguna, Pirojpur, and Jhalokati. This wide geographical jurisdiction reflects the diverse economic activities taking place in the region, ranging from agriculture to trade and commerce.

Role in Revenue Collection:

The Taxes Zone Barisal plays a crucial role in revenue generation for the government. The collection of income tax from individuals and businesses is a primary focus. The zone conducts tax assessments, audits, and investigations to ensure that taxpayers are in compliance with tax laws and regulations.

Moreover, VAT collection is also a significant source of revenue for the government. Taxes Zone Barisal works diligently to ensure businesses and traders within its jurisdiction adhere to VAT regulations. This includes monitoring VAT registration, filing, and payment processes to prevent tax evasion and promote transparency in economic transactions.

Challenges and Initiatives:

Like any tax authority, Taxes Zone Barisal faces its own set of challenges. Tax evasion, especially in the informal sector, remains a persistent issue. Ensuring compliance from small businesses, farmers, and self-employed individuals can be particularly challenging.

However, the zone has implemented various initiatives to overcome these challenges. These include:

-

Digitization: The adoption of digital platforms for tax filing and payment has improved efficiency and transparency. Taxpayers can now submit their returns and payments online, reducing the burden of paperwork and minimizing errors.

-

Taxpayer Education: Taxes Zone Barisal conducts taxpayer awareness programs and workshops to educate the public about their tax obligations and benefits. This helps foster a culture of voluntary compliance.

-

Enforcement: The zone has strengthened its enforcement efforts, conducting regular audits and investigations to identify tax evasion and take appropriate action against non-compliant individuals and businesses.

-

Outreach: Engaging with local communities and businesses through outreach programs helps build trust and cooperation between taxpayers and tax authorities.

-

Collaboration: Collaborative efforts with other government agencies, such as customs and excise departments, help streamline tax collection processes and prevent cross-border tax evasion.

Conclusion:

Taxes Zone Barisal plays a crucial role in the economic development of the southern region of Bangladesh. By efficiently collecting taxes and promoting compliance, it contributes to the overall fiscal stability of the country. Despite the challenges it faces, the zone’s dedication to modernization, education, and enforcement is essential for achieving a fair and robust taxation system that supports the growth and prosperity of the region and the nation as a whole.

How to Apply:

To apply for a position at Taxes Zone Barisal BSLTAX, interested candidates are advised to follow the application procedures outlined in the official job advertisement. This typically involves submitting an application form, along with the necessary documents such as educational certificates, experience letters (if applicable), and a recent passport-sized photograph. The application process may be conducted online or through offline submission, as specified in the job circular.

Important Note:

Candidates are advised to carefully review the eligibility criteria, required qualifications, and application deadlines mentioned in the official job circular. Ensure that all necessary documents are provided accurately and within the designated timeframe to complete the application process successfully.

Contact Information:

For any further inquiries or clarification regarding Taxes Zone Barisal BSLTAX job vacancies, interested individuals can reach out to the Taxes Zone Barisal BSLTAX through the following contact details:

Taxes Zone Barisal BSLTAX

Organization Type: Government Organization

Head Office Address: Barisal, Bangladesh

Phone: N/A

Email: N/A

Official Website: https://tax.barisal.gov.bd/

Taxes Zone Barisal BSLTAX Jobs Post Names and Vacancy Details

Taxes Zone Barisal BSLTAX is currently seeking qualified individuals to fill multiple positions across various departments. While the specific job titles and number of vacancies may vary, some of the common post names may be available.

Taxes Zone Barisal BSLTAX Job Circular 2023 PDF/Image:

The official Taxes Zone Barisal BSLTAX Job Circular 2023 PDF has been released by the Taxes Zone Barisal BSLTAX authorities. The PDF file can be downloaded using the provided link.

Source: Online

Online Application Start Date: 11 October 2023

Application Deadline: 31 October 2023

Application Method: Online

Apply Online: http://bsltax.teletalk.com.bd

Taxes Zone Barisal BSLTAX Job Circular 2023 PDF Download:

The Taxes Zone Barisal BSLTAX job circular 2023 PDF on https://tax.barisal.gov.bd/ and http://bsltax.teletalk.com.bd. For your convenience, we have downloaded the PDF file and attached the Taxes Zone Barisal BSLTAX circular 2023 PDF download link here.

| Download PDF |

Taxes Zone Barisal BSLTAX Job Application Procedure:

To apply for the Taxes Zone Barisal BSLTAX job circular 2023, follow the steps outlined below:

01) Visit the Taxes Zone Barisal BSLTAX Teletalk official website: http://bsltax.teletalk.com.bd.

02) Click on the “Application Form” option.

03) Select the desired position you wish to apply for.

04) Click on the “Next” button.

05) If you are a premium member of alljobs.teletalk.com.bd, select “Yes”; otherwise, select “NO.”

06) Fill in the application form accurately and proceed to the next step.

07) Upload your recent color photograph and signature photo.

08) Click on the “Submit Application” button.

Finally, download your Taxes Zone Barisal BSLTAX applicant’s copy and print it for future reference.

Application Fee Payment Method:

Applicants can pay the Taxes Zone Barisal BSLTAX job application fee by sending 2 SMS from any Teletalk prepaid SIM within 72 hours after submitting the online application form. Follow the SMS format provided to pay the application fee.

Taxes Zone Barisal BSLTAX online application form. Follow the SMS format below to pay the application fee.

SMS format for application fee payment:

(a) SMS: BSLTAX <Space> User ID send to 16222

Example: BSLTAX FEDCBA

Reply SMS: Applicant’s Name. Tk. 56-112 will be charged as an application fee. Your PIN is (8-digit number) 87654321.

(b) SMS: BSLTAX <Space> Yes <Space>PIN – send to 16222 Number

Example: BSLTAX YES 87654321

Reply SMS: Congratulations, Applicant’s Name. Payment completed successfully for Taxes Zone Barisal BSLTAX Application for xxxxxxxxxxxxxx. The user ID is (FEDCBA) and the Password is (xxxxxxxx).

Taxes Zone Barisal BSLTAX Admit Card:

Candidates will be notified via SMS to their mobile numbers once the Taxes Zone Barisal BSLTAX admit card is issued. The admit card can be downloaded using the User ID and password through http://bsltax.teletalk.com.bd.

Taxes Zone Barisal BSLTAX Job Exam Information:

The Taxes Zone Barisal BSLTAX recruitment examination for the job circular 2023 will consist of a written exam, a practical exam (where applicable), and a viva exam. The authorities will announce the exam date, seat plan, and results on the official website https://tax.barisal.gov.bd/.

Taxes Zone Barisal BSLTAX Exam Date, Seat Plan, Result:

The authorities will publish the Taxes Zone Barisal BSLTAX exam date, seat plan, and result on the notice board of the official website www.brtc.gov.bd. You can also find the Taxes Zone Barisal BSLTAX examination date, seat plan, and Taxes Zone Barisal BSLTAX exam result 2023 PDF on our PROGGAPON Website.

The Taxes Zone Barisal BSLTAX job circular 2023 is a great opportunity for those seeking government jobs in Bangladesh. To read more Gov’t Job Circulars 2023, such as the Taxes Zone Barisal BSLTAX job circular 2023, check the Government Jobs category. You can also find recent Bank Job Circulars 2023 and Company Job Circulars 2023 on our website.

More Government Job: Tax Commissioner Office Job Circular

We have provided all the necessary information regarding the Taxes Zone Barisal BSLTAX job circular for 2023 and the Taxes Zone Barisal BSLTAX Teletalk job circular for 2023.

Assalamu Alaikum, I am emran. I constantly engage in pondering about innovative ideas, and I absolutely love to travel and explore new places. Moreover, I cherish the rejuvenating benefits of quality sleep, which helps me stay energized and focused.